Jim Bilous/Shutterstock.com

Without inherited wealth, access to opportunity and right to move into thriving, more stable neighborhoods, Black wealth has remained abysmally low. Renting was rarely a choice, rather the only viable solution. This is still clear today in the disparity in home ownership rates between White and Black people. What’s more, urban landlords have driven up urban rents, especially within Black communities. Rents for similar, or often worse, properties are significantly higher for Black people. Despite the units being identical and in the same neighborhood, Black people have either been turned away with artificially manipulated pricing or forced to pay exorbitant rents.

COMMON GOALS

Generational wealth is what our parents seek to achieve for us. The investments, real estate and inheritances they leave behind are a major step towards financial freedom and independence for millions of people. These very inheritances have been the subject of long-standing debates over government tax policy and how to divide inheritances between children. Whether it be thousands or millions, the passing of generational wealth works to ensure an individual’s children will have numerous opportunities to pursue life, liberty and their own pursuit of happiness.

The average American household net worth is $692,100. This figure calculates all of the assets a household owns such as savings, investments, real estate and deducts from it any debt or liabilities. Within this average household net worth figure, typically the largest asset is the home(s). For most of America, the home represents not only shelter but the majority of people’s financial footing. Such was evident when the housing bubble burst in 2007-08 and left millions of Americans with crippled home values and often massive debts incurred through worthless mortgages.

NO COINCIDENCE

Not everyone, however, has the ability to purchase a home. Many choose to rent. Renting provides a lower cost alternative for housing for those who do not have firm financial footing or are unwilling to commit to the long-term ordeal of home ownership. However, renting does not increase net worth and does not contribute towards creating lasting, meaningful generational wealth. For some communities, renting is not so much a choice as it is the only viable option.

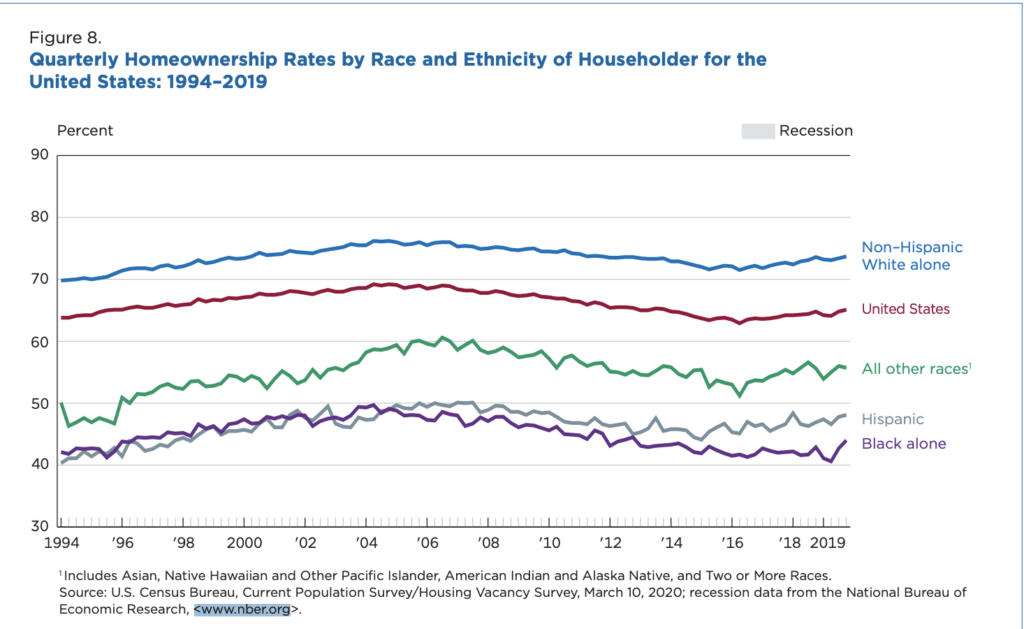

The Home Ownership Rate in the United States according to the last census is roughly 63%. Among White Americans, home ownership is nearing 75%, the highest among all demographics. Black Americans stare at a far bleaker reality as Black home ownership rates near a meager 45%, the lowest among all racial groups. Considering home values are the largest factor in a household net worth, the gap in net worth between White and Black Americans is severe. The disparity between average White and Black net worth is roughly five times the average Black net worth, $950,000 and $150,000 respectively.

As a whole, there is no denying the incredible advantage the average White American individual will have in establishing financial stability over their Black American counterpart. This shocking gap in generational wealth manifests itself through access to education, proper healthcare and living conditions. Therefore, with unequal access to outlets of opportunity, the gap of generational wealth continues to multiply and cement itself. To understand the roots of these disparities, we can turn to housing and districting laws made in American urban centers.

The difference in wealth is no coincidence nor is it a natural event. The dwarfing of Black net worth by White net worth was by design.

UNEQUAL OPPORTUNITY

To extract an ideal example, we can look at a phenomenon called “Redlining” employed in cities nationwide throughout the 20th century. Redlining refers to the explicit drawing of lines on districting maps during the mass construction of new homes in the early-mid 20th century. Born from the New Deal, massive construction of homes was underway providing families new possibilities of new, fresh and vibrant neighborhoods. The caveat was that none of these new homes and neighborhoods could be sold to Black families regardless of their ability to make a substantial bid. This state-sponsored segregation remanded Black prospective home-owners to wholly-Black communities and effectively created government created ghettos. Not only were Black Americans unable to buy property in safe, prosperous and valuable neighborhoods with good education systems, they were also often banned from purchasing property all-together.

As previously mentioned, renting can be an effective alternative to home ownership for those without financial stability or an unwillingness to commit. However, Black Americans have historically been forced into renting which prevents the accumulation of wealth and the establishment of substantial generational wealth. Millions black Americans were shunned into ghettos that suffered from segregationist and overtly discriminatory regulations. Municipal governments suppressed home values, practically to the point where investment was futile, by creating laws prohibiting standard garbage collection among other basic services.

Compounded with legal denial of equal opportunity of housing, free of discrimination, is the “de facto” forms of housing discrimination that cripple black net worth and stunt financial empowerment. Largely considered one of the most common forms of “de facto” discrimination is that of “white flight” that follows similar logic to that of the “one drop rule” of the Jim Crow South. A single Black family walking in the neighborhood could frighten White homeowners so deeply that they sold their homes. Seeing Black families move into a neighborhood, to this day, often is followed by an exodus of White families and a subsequent tanking of home prices. However, this process was not purely a natural event caused by the engrained racist attitudes of White Americans. A phenomenon called “blockbusting” was a practice endorsed and promoted by real estate lobbies and organizations nationwide. Blockbusting consisted of realtors planting a Black family in a park or calling White families with fabricated Black names. As White families left in a hurry, real estate agents profited from gobbling up properties with reduced pricing. Not only were Black people barred from neighborhoods, but real estate agents nationwide abused the racist tendencies of white families to draw unnatural profits.

US Censorship Bureau/ Natl Bureau Econ. Research

TRUE VALUE

As sociologist Michael Desmond posits, the home is the center of life. Many see the home as the center for calm and stability, a necessity for harmony in the family and the key to opportunity. However, the home is far more than the roof and walls it provides. It represents the dominant majority of household’s net worth that are eventually passed on to their children. The value found in real estate assets is fundamental in-home life stability, access to education and the freedom to pursue one’s own passions without threat of crippling poverty. When we look at crime rates, income disparity and education levels it is impossible to overlook the criminal disparity in generational wealth. If Black families are turned away from adequate housing and denied their right to equal treatment due to explicit laws or “de facto” segregation, as sanctified and defended by the Supreme Court, then racial equality will forever remain achievable.

About the Article

A look at the disparity in White and Black net worth through real estate.